Durable Medical Equipment (DME) billing is a cornerstone of revenue cycle management in healthcare. However, its intricate processes and ever-changing regulations often pose challenges that can impact a provider’s bottom line.

Did you know that an estimated 20-30% of DME claims are initially denied, with errors in documentation and coding being the primary culprits? These statistics underline the importance of adopting robust strategies to streamline DME billing and maximize revenue.

This blog will explore actionable DME billing strategies to help providers enhance their revenue cycle, minimize claim denials, and ensure compliance.

Whether you’re a seasoned healthcare professional or new to the DME sector, these insights will empower you to boost efficiency and financial outcomes.

Durable Medical Equipment (DME) billing refers to the specialized process of handling claims for medical equipment prescribed by healthcare providers.

This equipment includes wheelchairs, oxygen equipment, and prosthetics, essential for patient care and long-term health management.

The primary purpose of DME billing is to ensure timely reimbursement from insurance providers while adhering to complex compliance guidelines.

Accurate billing secures revenue for providers and facilitates uninterrupted care for patients who rely on these critical devices.

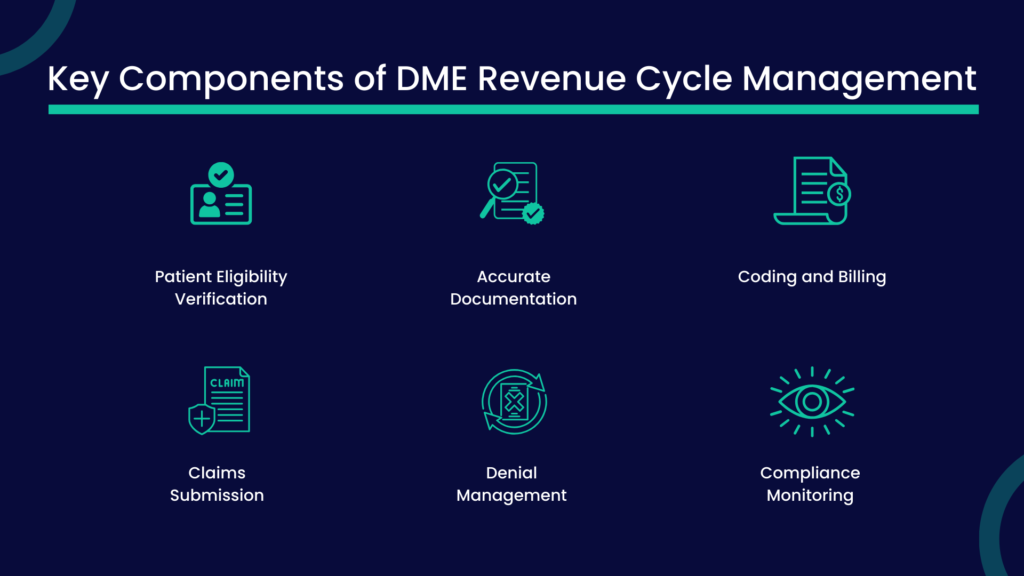

Effective DME revenue cycle management is the backbone of optimizing financial performance in the DME sector. It encompasses several vital components:

DME billing is complex, and if not handled meticulously, it can lead to delayed reimbursements or claim denials. Understanding these challenges is the first step toward effectively addressing them.

The intricacies of DME billing codes, particularly HCPCS codes, can be daunting. Each equipment or service requires precise coding to reflect its purpose and usage.

Any mismatch or omission can lead to rejected claims, impacting revenue. Additionally, the frequent updates to coding systems demand continuous learning and adaptation by billing teams.

DME billing requires an exhaustive amount of documentation to meet payer requirements. This includes:

Incomplete or inaccurate documentation is a leading cause of claim denials, emphasizing the need for meticulous record-keeping and verification processes.

Each insurance provider has unique billing guidelines and reimbursement policies, making standardization nearly impossible.

Navigating these varying requirements can be overwhelming, especially for providers handling claims from multiple payers. Failing to meet payer-specific expectations often results in claim delays or denials.

The DME industry operates under strict regulatory frameworks, including Medicare and Medicaid policies. Providers must comply with eligibility rules, billing timelines, and documentation accuracy. Non-compliance can result in hefty penalties or audits, further straining resources and revenue cycles.

Addressing these challenges requires robust systems, skilled personnel, and continuous updates to billing processes.

Errors in DME billing are not uncommon, but they can have significant financial repercussions. Identifying these pitfalls and implementing preventative measures is essential for a seamless revenue cycle.

Coding errors, such as incorrect HCPCS codes or missing modifiers, are among the most frequent mistakes in DME billing.

These inaccuracies lead to claim denials or underpayments, resulting in lost revenue and additional rework.

Incomplete or inaccurate documentation, such as missing physician prescriptions or insufficient medical necessity forms, is a primary reason for claim denials. Without proper documentation, payers often reject claims outright.

Failing to adhere to different insurance payers’ diverse and specific requirements can lead to prolonged payment delays or outright denials.

Each payer may have unique policies regarding billing formats, submission timelines, and documentation.

Maximizing revenue in DME billing requires more than just attention to detail—it demands proactive strategies and a well-organized approach. Below are some proven strategies to help providers streamline their billing processes and boost financial outcomes.

Adequate documentation is the cornerstone of successful DME billing. Missing or incomplete paperwork is a common reason for claim denials, and it can significantly impact cash flow.

Modern technology can drastically improve the accuracy and speed of DME billing processes. By automating repetitive tasks, providers can reduce errors and free up resources for other critical activities.

Specialized DME billing software is designed to handle the complexities of coding, claim submission, and compliance.

Integrating billing systems with electronic health record (EHR) platforms streamlines data sharing and reduces manual entry errors.

Regular audits are essential for identifying gaps in the billing process and preventing revenue leakage.

Strict and ever-evolving regulations govern the DME billing landscape. Staying compliant is crucial to avoid penalties and ensure claim acceptance.

Establishing solid connections with insurance payers can simplify billing processes and improve claim approval rates.

Implementing these strategies can help DME providers transform their billing practices into streamlined, efficient processes that maximize revenue and minimize disruptions.

An optimized revenue cycle ensures financial stability and efficiency in DME billing. By addressing key areas of the cycle, providers can achieve faster reimbursements and minimize revenue loss.

Efficient claims submission is the foundation of a well-functioning revenue cycle. Delayed or incomplete claims often disrupt cash flow.

If not addressed promptly, claim denials and rejections can significantly impact revenue. Preventative measures are key to minimizing these issues.

Timely tracking and follow-up on payments ensure no revenue slips through the cracks.

Well-trained staff are essential for a smooth revenue cycle. A knowledgeable team can reduce errors and improve operational efficiency.

Technology is transforming the DME billing landscape, offering solutions that enhance efficiency, accuracy, and overall financial performance.

Automation and artificial intelligence (AI) are game changers in revenue cycle management. These technologies help reduce human error, accelerate claim submissions, and simplify complex billing tasks.

Key Applications:

Pro Tip: Use AI tools to predict claim outcomes and optimize submission strategies.

Cloud-based billing systems offer flexibility and scalability, making them ideal for DME providers.

Advantages:

Data-driven decision-making is crucial for optimizing the revenue cycle, and real-time reporting tools provide the insights needed to make informed choices.

Why It Matters:

Pro Tip: Use analytics to forecast revenue and plan for operational improvements.

Technological advancements in DME billing lead to tangible financial benefits that directly impact the bottom line.

Automated claim submission and tracking systems accelerate the reimbursement process by ensuring accuracy and reducing delays.

Streamlined workflows and automation minimize the time and effort spent on manual tasks, leading to significant cost savings.

Technology simplifies billing processes, allowing providers to focus more on patient care. Transparent billing systems also help patients understand their financial responsibilities better.

A well-organized checklist ensures that DME billing processes are efficient, accurate, and compliant. By following key processes and utilizing the right tools, providers can streamline operations and maximize revenue.

Here’s a quick reference to ensure all essential steps are covered in the DME billing process:

To optimize the DME billing process, consider using these tools and implementing best practices:

Staying compliant with regulatory standards is essential for DME providers to avoid financial penalties and ensure smooth billing operations. By keeping up with evolving regulations, providers can maintain high levels of efficiency and mitigate risks associated with non-compliance.

DME billing is subject to constantly changing guidelines set by regulatory bodies like CMS (Centers for Medicare and Medicaid Services) and private insurers.

Staying up to date with these guidelines ensures that claims are processed correctly, reducing the risk of denials or delays.

Failure to comply with DME billing guidelines can result in fines, audits, and even the loss of a provider’s ability to bill for services. Proper adherence to compliance standards safeguards against these penalties.

Audits are a common occurrence in the DME industry and can be triggered by errors or irregularities in billing. Proactively preparing for audits helps providers respond effectively and avoid disruptions.

How to Prepare:

The future of DME billing will be shaped by advancements in technology, shifting insurance policies, and evolving healthcare regulations. Providers who stay ahead of these trends will be better positioned for success in the coming years.

Emerging technologies are expected to revolutionize the DME billing process. Automation, artificial intelligence (AI), and machine learning will continue to play a key role in improving billing accuracy, speeding up reimbursement times, and reducing administrative costs.

What’s Coming:

The insurance landscape is changing, with payers increasingly adopting value-based care models and prioritizing cost-effectiveness.

DME providers will need to adapt their billing practices to align with these evolving expectations.

What to Watch For:

New healthcare policies and regulations, such as Medicare and Medicaid coverage changes, could significantly impact DME billing practices. Providers must stay informed about these changes to adjust their processes accordingly.

Key Areas to Monitor:

Successfully managing DME billing is essential for maximizing revenue and maintaining smooth operations within the healthcare system.

While the challenges in DME billing can seem complex, staying proactive and informed will ensure long-term financial success and business growth.

If you want to streamline your DME billing processes and ensure optimal revenue cycle management, Promantra is here to help.

With our comprehensive solutions, including expert guidance on billing practices and cutting-edge technology integration, we help healthcare providers stay compliant and achieve maximum revenue.

Visit Promantra today to learn how our services can support your business and drive success.