DME billing was a maze of inconsistent documentation and frequent claim denials. The Centers for Medicare & Medicaid Services (CMS) introduced the Standard Written Order (SWO) to improve clarity and standardization, ensuring that a clear, structured prescription supports every claim.

While CMS set the foundation, private payers added their layers of requirements, making compliance tricky. A missed detail can result in delayed reimbursements or outright denials.

This blog unpacks payer-specific SWO requirements in DME billing, helping you stay compliant and maximize claim success.

A Standard Written Order (SWO) is a formal prescription required for Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS).

It ensures that the prescribed equipment or supplies are medically necessary and appropriately documented.

According to the Centers for Medicare & Medicaid Services (CMS), an SWO must include:

Before the CMS-1713 Final Rule was implemented, a Detailed Written Order (DWO) was required for DMEPOS items.

The DWO often included more detailed information, such as specific usage instructions and additional documentation.

The transition to the SWO aimed to streamline the ordering process by standardizing the required elements, thereby reducing administrative burdens and potential errors. This change was part of CMS’s efforts to simplify and harmonize DMEPOS order requirements.

The CMS-1713 Final Rule, Effective January 1, 2020, mandated using the SWO for all DMEPOS items billed to Medicare.

This rule created a standardized set of required elements for DMEPOS orders, thereby reducing confusion and enhancing compliance among providers and suppliers.

The Final Rule also introduced a Master List of DMEPOS items that could be subject to additional requirements, such as face-to-face encounters and written orders before delivery.

In the complex world of DME billing, understanding the payer-specific SWO guidelines is crucial for ensuring timely and accurate reimbursements.

While all payers require an SWO, the documentation rules can vary between Medicare, Medicaid, and private insurers.

Let’s explain how each payer type handles SWO requirements and where variations might occur.

Medicare is the gold standard for DME billing, setting clear guidelines under the CMS-1713 Final Rule. As mentioned earlier, the SWO must include basic information, such as:

Medicare is strict about adhering to these requirements, and any missing information can lead to claim denials.

Additionally, Medicare requires that some items go through a prior authorization process before an SWO is submitted.

Each state administers Medicaid, which means that SWO requirements can vary depending on where the patient resides.

Some states may require more detailed descriptions of the equipment, while others may mandate additional forms or specific order numbers.

It’s crucial for DME suppliers to check the individual state’s Medicaid guidelines to avoid noncompliance and billing delays.

Private insurance companies often have their own set of SWO documentation requirements, which may differ from Medicare’s.

While the basic elements like the patient’s name, order date, and physician’s signature are common, private insurers may request more specific details.

For example, they might request more precise descriptions of the equipment or additional diagnostic codes to justify the medical necessity.

Suppliers should always verify the specific requirements for each insurer to avoid costly errors.

In many cases, prior authorization is required before the SWO is submitted, especially with higher-cost or complex DME items.

This means that suppliers must submit documentation supporting the medical necessity of the item in addition to the SWO.

This includes physician notes, test results, and detailed usage plans. Some payers, including Medicare and private insurers, may also require periodic recertification to continue coverage of the DME item.

A face-to-face (F2F) encounter is critical to the DME billing process. It’s required to establish medical necessity for certain DME items, ensuring that the item is truly needed by the patient and prescribed by a licensed healthcare provider.

Under Medicare’s guidelines, an F2F encounter is necessary for most DME items classified as medically necessary.

This encounter should occur within six months of the order date and is generally required for items such as wheelchairs, walkers, and oxygen therapy.

For some high-cost items, such as power mobility devices, the F2F encounter is mandatory before a Standard Written Order (SWO) can be submitted for reimbursement.

For Medicare, the F2F encounter should occur before the SWO is signed, and documentation must clearly indicate the patient’s condition and why the prescribed DME is necessary for their treatment.

To meet F2F requirements, the documentation must include:

This documentation must be thorough and clear to avoid claim denials and ensure the provider’s compliance with payer-specific guidelines.

F2F-related denials are common when documentation is insufficient or when the timing of the encounter does not align with the SWO requirements. Here are some tips to avoid these denials:

The accuracy of SWO documentation is crucial to ensuring timely and successful reimbursement for DME items.

Document errors can lead to claim rejections, payment delays, and even compliance risks. Let’s explore common mistakes and ways to avoid them.

Several common errors can cause a SWO to be rejected by payers:

Signature issues are among the top reasons for SWO rejections. Common signature problems include:

To avoid these risks, ensure the treating physician correctly signs the SWO and double-check that the physician’s information matches the payer’s records.

Another critical factor in avoiding claim denials is timeliness. Submitting the SWO after the delivery of DME is a frequent mistake that leads to rejections.

Ensure that:

Maintaining compliance with SWO documentation requirements is key to avoiding claim rejections and ensuring smooth reimbursement for DME items.

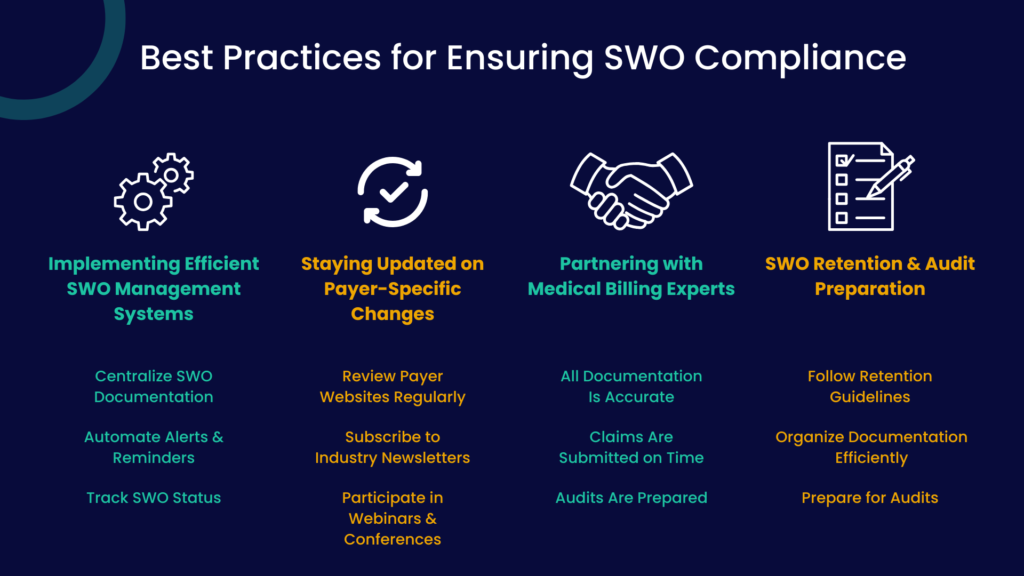

Implementing a robust management system is one of the most effective ways to ensure SWO compliance. This system should:

An efficient SWO management system ensures that no paperwork slips through the cracks and helps prevent delays or denials due to missing or incorrect information.

Payer-specific SWO guidelines can change frequently. It’s crucial to stay updated on any modifications or new requirements from payers, especially Medicare, Medicaid, and private insurers.

To do so:

Being proactive about these changes ensures that your SWO documentation stays aligned with payer rules, preventing avoidable rejections.

Working with medical billing experts can help improve SWO compliance and prevent errors. These professionals bring valuable knowledge and expertise, ensuring that:

Partnering with experts can reduce the administrative burden and help ensure compliance across all aspects of SWO documentation.

Proper retention of SWO documentation is essential for compliance, especially in the event of audits. To ensure readiness:

A systematic approach to SWO retention and audit preparation reduces non-compliance risk and ensures that documentation remains intact and readily available when needed.

Ensuring that your SWO (Standard Written Order) documentation is stored correctly is key to maintaining compliance and streamlining the claims process.

Store SWO documents in a centralized, cloud-based system to ensure easy retrieval and secure backup.

This saves time when retrieving documents and enhances data security and accessibility, especially when preparing for audits.

Ensure each SWO is correctly indexed by patient name, service type, and service date. This organization will help you locate specific documents quickly, especially when dealing with multiple patient claims.

Ensure you retain all SWO documents for the required period, typically 7 years for Medicare and longer for other payers.

Using a digital system with retention features can help you track deadlines and avoid penalties for missing documents.

Compliance with HIPAA standards is vital for patient confidentiality. Encryption and other security measures should be used to protect all SWO documentation from unauthorized access.

Payer audits are a common risk in DME billing, and certain actions or patterns can trigger these audits.

Being aware of these triggers can help you take steps to ensure your SWO documentation is always ready for review.

Submitting many claims for expensive DME items (e.g., wheelchair oxygen therapy) could prompt an audit.

Preparation Tip: Ensure that every claim is accompanied by complete, accurate SWO documentation and that each item prescribed is medically necessary, with detailed justification for its use.

Unusual or inconsistent billing patterns, such as frequently changing codes or billing for items rarely prescribed, can raise red flags.

Preparation Tip: Keep a consistent and accurate record of all DME items billed, supporting each claim with robust medical documentation and valid SWOs.

A high rate of rejected claims due to SWO errors can signal to payers that your documentation practices are problematic.

Preparation Tip: Perform regular internal audits of SWO documentation to identify and address recurring issues before they become problematic.

Patient complaints or allegations of fraud can quickly trigger audits.

Preparation Tip: Keep all communication with patients documented and ensure that SWOs accurately reflect the prescribed items and meet medical necessity requirements.

Failure to comply with SWO documentation requirements can result in penalties, including claim denials, delayed reimbursements, and even suspension of billing privileges.

Here’s how to avoid SWO-related penalties:

Accurate SWO documentation is essential to avoid penalties. Ensure each SWO includes the necessary information, such as patient data, physician signatures, and the specific DME item. Any missing or incomplete information can result in denials and penalties.

Failure to submit SWOs within the required timeframes can delay payments and result in penalties.

Therefore, ensuring that all SWOs are submitted as soon as possible and adhere to payer-specific deadlines is important.

Payers can change their SWO requirements at any time. It is crucial to keep up with these updates to avoid penalties.

Tip: To stay informed, regularly check payer websites for updates and sign up for newsletters or updates from billing groups and payer organizations.

Conducting routine internal audits ensures that your SWO documentation complies with payer-specific guidelines and helps identify errors before they affect claims submission.

Collaborate with medical billing experts to ensure your SWO documentation and overall claims process are up to standard.

Professionals can help you navigate complex payer-specific requirements, reducing the risk of costly errors.

Navigating payer-specific SWO guidelines in DME billing can be complex and time-consuming. However, you can minimize the risk of denials and penalties by staying informed about Medicare, Medicaid, and private insurer requirements, implementing strong documentation practices, and preparing for audits.

Adopting best practices for SWO management ensures smoother claims submissions, faster reimbursements, and better compliance with payer expectations.

Staying on top of SWO documentation can be challenging, but you don’t have to do it alone. Promantra offers expert support in medical billing and coding to help ensure your DME claims are always compliant with payer-specific SWO requirements.

Get in touch with Promantra today and streamline your SWO documentation process so you can focus on what matters most—growing your business with confidence.